You're the owner of a Texas business and you need to make sure that there is still enough money coming in during a time when it seems like everything has gone wrong.

Business owners have to be aware of the many different types of insurance coverage that they will need in order to run a successful business. Among these are liability and property damage, which is often called "business income" or BI for short.

This type can handle loss due to lawsuits as well as other events such as fire, theft, vandalism, and natural disasters like Texas-sized hailstorms where physical structures could sustain significant structural damages. This can result in some hefty repair bills not covered under homeowners' policies because it's technically considered 'business activity.

And let’s say you don't want your hard-earned savings supporting someone else's lawsuit over an accident on company time.

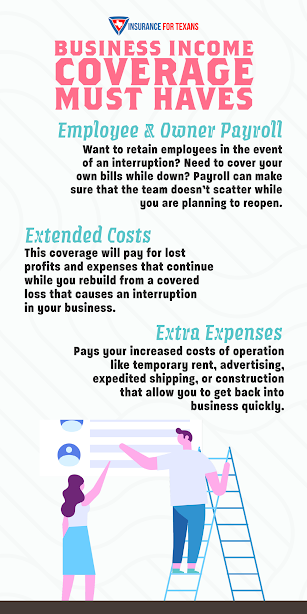

There are 3 important facets to this type of policy.

Employee and Owner Payroll

If you suffer a business interruption, the most important thing for you right now, though, is keeping everyone together so they can help one another out while also accomplishing work tasks—you don't want them scattering just because someone isn't being paid.

Keeping employees around after an interruption or shutdown might take some extra planning (and investment) on your part but doing this will not only keep morale up among workers who could be feeling uncertain about their future with the company; it'll ensure that people are always available to come back quickly once things have returned to normal again!

Preparing for the worst is never a bad idea. In case of an interruption, make sure your team doesn't scatter by preparing with payroll services that can help you pay employees and cover other bills while determining when to reopen.

Extended Costs

This coverage will pay for lost profits and expenses that continue while you rebuild from a covered loss that causes an interruption in your business. This can be very helpful if the disruption to operations is prolonged or leaves you with no revenue during recovery efforts.

A lot of businesses are faced with sudden, unplanned interruptions every day due to weather events like hurricanes, tornadoes, flooding, etc., which devastate entire communities causing property damage as well as blocking access points between towns and cities disrupting travel routes within states/countries too!

In these instances, it's important to have insurance so nobody suffers any financial losses on top of their homes being destroyed by natural disasters such as flooding (which we've seen our fair share of in Texas!) The Extended Cost Coverage from the insurance company will help your business get back on its feet in a time of need. If you suffer an interruption that is covered under this plan, then they'll not only compensate for lost profits and expenses but also cover those costs during the rebuilding process

While your business is closed, any extra expenses you incur will have to be paid out of pocket. This includes increased rent for temporary accommodation or advertising costs if there's a chance someone can still find the store after it closes up shop. Expedited shipping and construction materials are also necessities that keep things rolling in case something breaks down and needs an emergency fix before reopening day arrives

Extra Expenses

While doing business, extra expenses come with the territory when things go wrong, such as unexpected events like natural disasters between now and re-opening day.

You know your company is back on its feet when you find yourself shelling out extra expenses. Temporary rent, advertising for a new business model, expedited shipping to make sure that customers are satisfied... all these things cost more than before but they're worth it if we can get our reputation and customer base up again!

You want to be able to bounce right back from any financial difficulties so an increase in overhead may seem like just one more thing going wrong--but don't let those temporary costs scare you off too much; after all the money spent will come with some pretty big benefits down the line.

Extra expenses are the costs associated with getting back into business quickly. They can include:

- temporary rent

- advertising to increase profit margins

- brand awareness

- expedited shipping in order to match demand as soon as possible

Construction may also be an expense when you're trying to expand your operations or get a new location up-and-running more efficiently than before so that you can compete better against other businesses nearby that have remained operational throughout this time period of economic downturns.

Having a solid BI policy will help you sleep at night as a business owner responsible for the livelihoods of your employees, and you're own ability to provide for you and/or your family.

We are business owners here at Insurance For Texans. We promise to put ourselves in your shoes as you weigh the risks, rewards, and offer the policies with coverages we'd want to cover us.

As an independent insurance agency, we have options in that regard.

Stay covered, Texas.