If you insure any type of commercial property, building, or contents, it is typical that your policy will include a coinsurance provision. With property insurance policies, coinsurance takes on a different definition than what you may be accustomed to on a health insurance policy with a coinsurance clause. Coinsurance is used by property insurance companies to encourage business owners to insure their property at full value, or as close to full value as possible. Briefly defined, coinsurance is an insured-to-value strategy utilized by insurance companies to make sure the property they are covering is insured as close to the rebuild value as possible.

Under the coinsurance provision of a property policy, you agree to insure your property at 80% / 90% / 100% of the property value. This percentage amount may vary by carrier and property characteristics. In the event, you do not insure your property to the appropriate coinsurance percentage required by the property insurance policy you will experience a "coinsurance penalty" in the event of a claim.

When reviewing a property, independent commercial insurance agents will utilize a replacement cost estimation software, typically CoreLogic, to determine the estimated replacement value of a property. This provides the agent with an estimated cost to rebuild the property as it stands today based on the property characteristics, location, and material costs. As a cost savings mechanism, some customers will choose to offset their premium by taking on more of the claims cost after their deductible by reducing the amount of property insurance limit that they are purchasing. Therefore instead of insuring the property at 100% estimated replacement cost, they chose to insure it for 85% of the estimated value per the property insurance coverage limits. This helps them save on premiums but leaves the client with their portion of the loss at 15% plus their deductible in the event of a total loss per the insurance contracts.

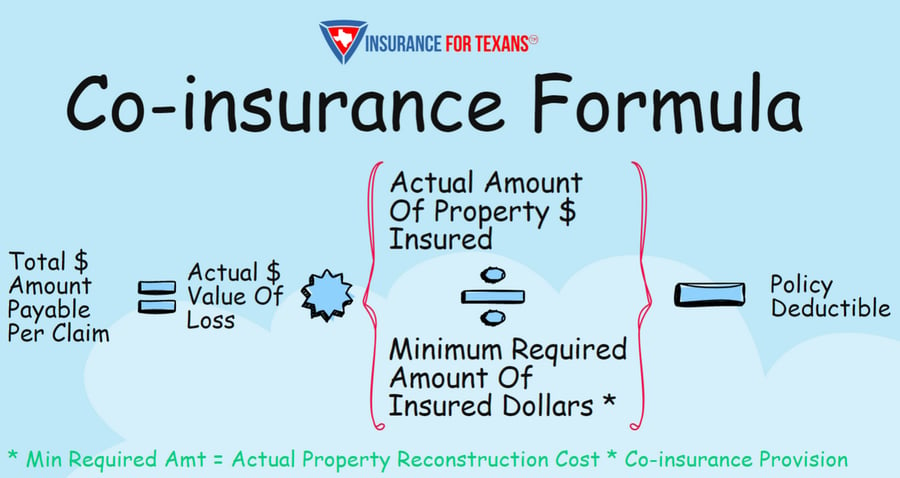

But what happens if the insured decides to insure the property at less than the 80% replacement cost? If the insured was to insure the property at 60% of the estimated replacement cost and the policy had an 80% coinsurance clause, the coinsurance clause of the policy would be triggered. Because you insured the property for less than the value agreed upon within the policy provisions you now take a “penalty” for under-insuring the property. This penalty is calculated via the formula below:

Co-Insurance Formula:

Scenario 1: CoInsurance Clause Is Satisfied:

- Property Insurance Policy Building Limit: $1,000,000

- The value of the building at the time of loss is $900,000

- The coinsurance percentage is 80%

- The minimum required amount of insurance should be at least $1,000,000 x 80% = $800,000

- Since the building limit meets the amount of insurance required under the coinsurance clause, the amount due to you (the claimant) is not affected

- The cost to repair the damage is $50,000

- The deductible amount is $1,000

- The amount payable based on replacement cost value is $49,000.

Scenario 2: CoInsurance Clause Is Not Satisfied:

- Property Insurance Policy Building Limit: $600,000

- The value of the building at the time of loss is $1,000,000

- The coinsurance percentage is 80%

- The minimum required amount of insurance should be at least $100,000 x 80% = $800,000

- Since the Property Insurance Policy Building Limit ($600,000) is less than the required coinsurance limit of $800,000 the coinsurance clause is triggered

- The cost to repair the damage is $300,000

- The deductible amount is $1,000

- Amount Payable = $300,000 * ( $600,000 / $800,000 ) - $1,000

- Amount Payable After Coinsurance Trigger: $224,000*

- This leaves you, the insured footing the bill for $76,000 in repair plus your deductible as a result of under-insuring your property.

In Conclusion:

When reviewing your business property insurance policies it is imperative that you make sure to value your buildings and business personal property as close to 100% value as possible. While we run replacement cost estimates on properties these are only estimates, having regular appraisals of your property, especially during times of high inflation is recommended to make sure your policy limits are as accurate as possible. In addition, when reviewing your contents coverage limits it is vital that you maintain a spreadsheet of equipment and values so that all new machinery and other items are accounted for at renewal. This is why it is so important that all business insurance property policies are reviewed annually to make sure all valuations are in line with the current replacement and rebuilding values.

If you would like a review and copy of your replacement cost estimate with our agency please contact us at 469-789-0220 or click the image below!