Once Insurance For Texans enacts a Grapevine Home Insurance policy for a homeowner, we intend our conversations will be those where we are just asking about family and the latest life events.

We hope we never have to hear about a claim or potential claim, but knowing the industry we are in, it is bound to happen.

One of the common questions we receive from homeowners is "Will this claim be worth it?"

If your home burns to the ground, there's no question. If your roof is leaking water, no question. Flooded living room due to burst pipe? No question.

But what about those odd situations where it is a lot less clear?

How do you know if a claim is worth it?

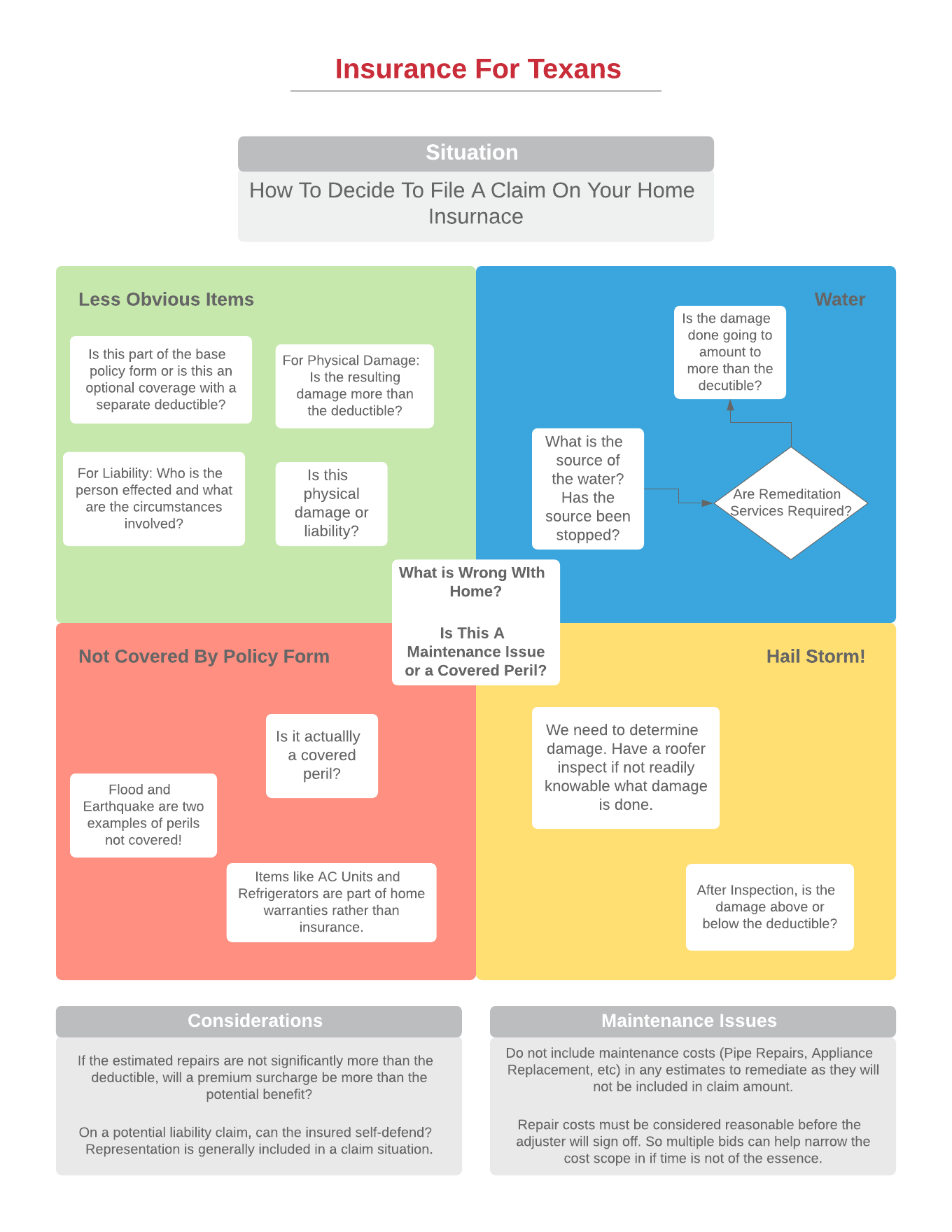

We advise by using a simple matrix to help a complicated situation become a little easier to understand when it comes to filing a claim. See below.

By using the grid, you see the very first step is determining if the event is covered by your home policy without regard to the type of claim.

For instance, a flood situation caused by a Texas flash flood wouldn't be covered by your homeowners insurance policy.

Moving on, you have to weed through some complication. If your property is damaged, we now estimate the cost to repair.

If there is a busted pipe involved, or an appliance that quit, then the amount of money to repair will deduct the cost to fix or replace those things from the amount paid to perform the property repair.

The insurance carrier deems that busted pipe and non-working appliance as your responsibility and will only bring your property back up to the point of repair of what it would have been if that pipe and appliance were already repaired.

Then it becomes an exercise of determining if the remaining balance to repair is greater than the deductible you have on your policy.

If it is not, why file a claim? You will have a claim on your insurance record and would not get to realize a benefit. This can cost you dollars down the road.

From this point, the next step is to figure how much benefit you would realize. If only a few hundred dollars, is it the wiser option to pay out-of-pocket instead of realizing a surcharge for a claim over the next three years?

Understandably, liability claims get more interesting and harder to decipher regarding when to claim.

We take the route of incorporating a claims adjuster to know how to best approach a liability claim, e.g., someone injuring themself on your property.

There's more nuance involved at that point and an adjuster brings valuable insight and guidelines to make certain your claim won't wind up as a poor decision for you.

A great thing about being an independent insurance agency, Insurance For Texans can help you plan and serve on your behalf to make sure you know when it is in your best interest to file a claim.

The right decision can save you a large sum in premiums down the road.

Need a plan before you claim? We can help.