Once folks have established a Burleson Home Insurance Policy with Insurance For Texans, we hope that all of our conversations are about your family and other life events. Inevitably, we will be forced to discuss claims and potential claims with some of those clients. The toughest question we can get always revolves around is a claim worth it! If your house burns down, no one asks if a claim is worth it. If your roof has holes in it, no one asks if a claim is worth it. If your entire house is flooded from a broken pipe, no one asks if it's worth it. But all of those smaller claims that aren't cut and dried make decisions tough. How do you know what to do?

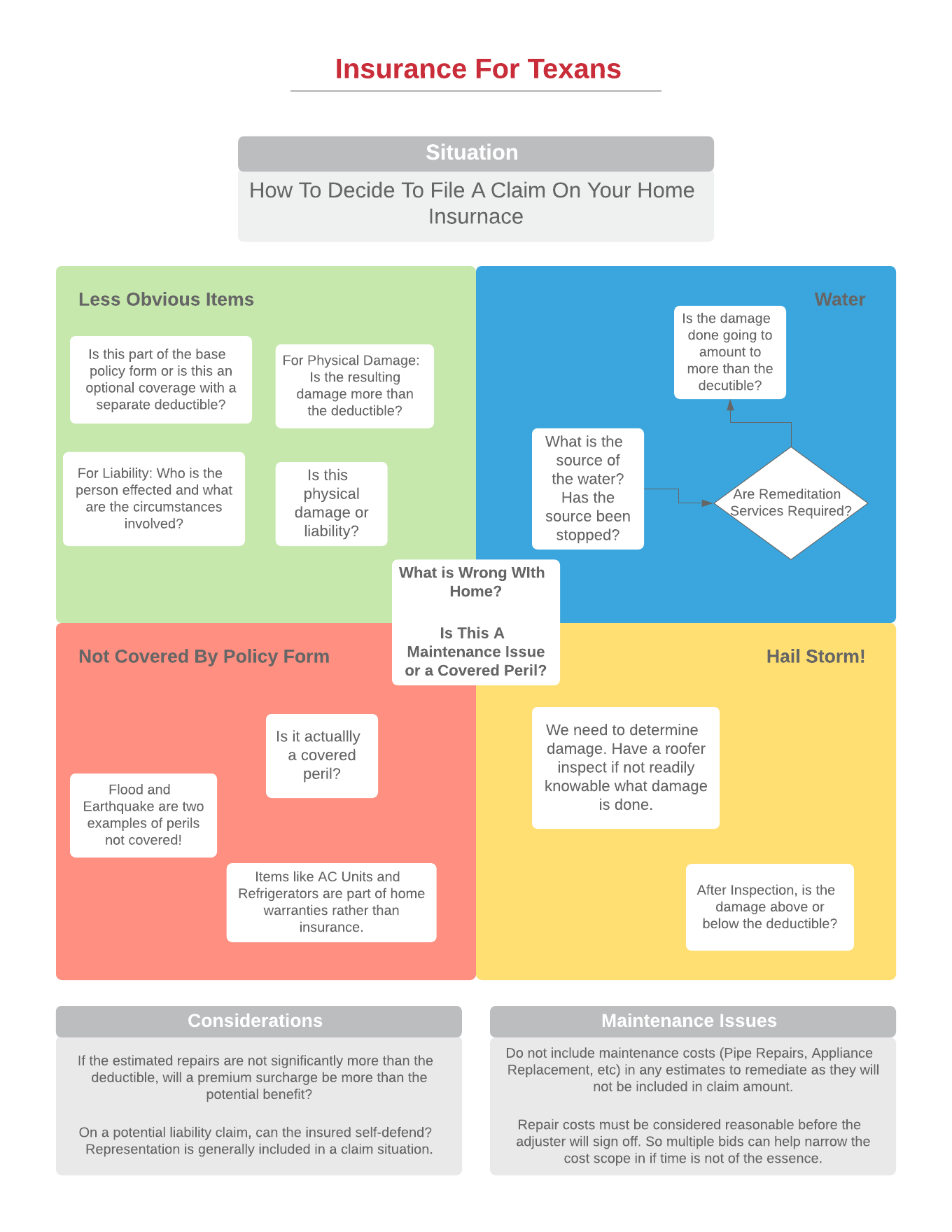

As a general rule, when a home owner calls or emails Insurance For Texans regarding a potential claim we move to a quick matrix to help them decide what to do next with respect to filing a claim.

In our grid, the first step is to determine if the event is covered by your home insurance policy no matter what kind of claim it is. An obvious example is going to be a flood situation. If your home flooded by a classic Texas Flash Flood, it won't be covered under your homeowner insurance policy.

From there, it becomes a bit complicated. For damage to your property itself, we focus on the estimated amount to repair the damage. If the damage to the property involved a pipe bursting, appliance deciding to crater, or a piece of furniture trying to commit suicide the amount of money to perform the maintenance repair to your home will be deducted from your repair bill by the home insurance company. They will only pay to put the house back the way it was after your hot water heater is replaced or the pipe is repaired. Of that remaining balance, the key is to determine if the amount is greater than your deductible amount on the policy. If not, there is no benefit to filing a claim. You will have it on your record and receive no benefit, and having it on your record means you can be surcharged for a claim.Where is the love on that one? The next step is to determine just how much benefit is there. If your only going to receive a few hundred dollars in benefit, it may make sense to pay the amount out of pocket rather than be charged for a claim for the next three years.

Liability claims are a lot more difficult to judge on when to claim. We prefer to call a claims adjuster to get a feel for how the claim will be approached. Liability can be cut and dried like a dog biting someone. But a someone tripping and falling on a crack in the sidewalk is a bit different. And thus the nuance of filing a claim and why we like to talk to an adjuster on your behalf first in an anonymous fashion to see if they have some set guidelines first.

The big key to these claim situations is that Insurance For Texans, as an Independent Insurance Agent, can help homeowners get a game plan by calling and speaking to claims people before you ever file a claim. We can speak with an adjuster before a claim is recorded on your record to formulate a game plan. That can save you hundreds if not thousands of dollars in premiums later on.

The big key to these claim situations is that Insurance For Texans, as an Independent Insurance Agent, can help homeowners get a game plan by calling and speaking to claims people before you ever file a claim. We can speak with an adjuster before a claim is recorded on your record to formulate a game plan. That can save you hundreds if not thousands of dollars in premiums later on.

If you aren't sure of what to, let Insurance For Texans help you put together a plan.